- Guidance

Seaweed Sector Framework

This co-developed roadmap shows how Aotearoa New Zealand could grow its rimurimu/seaweed sector in a way for the country to gain environmentally, socially and culturally as well as economically (October 2022)

Executive summary

The co-development of this framework covered many areas. In particular, the team identified 3 immediate and medium-term priority areas for the domestic seaweed sector, and made recommendations to address these gaps:

The framework was refined based on 6 case studies which feature existing and planned future seaweed ventures in Aotearoa:

The framework is underpinned by a comprehensive sector review which was conducted in 3 parts:

- Market and regulatory focus

- Species characteristics and Te Tiriti o Waitangi considerations

- Environmental effects of seaweed wild-harvest and aquaculture

The Seaweed Sector Framework

2032 vision for Aotearoa

The vision for the domestic seaweed sector is that by 2032 rimurimu/seaweed contributes significantly to Aotearoa New Zealand’s economy and supports thriving ecosystems, communities and culture.

Purpose of the framework

This Seaweed Sector Framework is a roadmap to help guide the development of a thriving, high-value seaweed sector that provides meaningful environmental, social and cultural benefits as well as economic to local communities and nationally.

Its intended audiences are leaders and kaitiaki (iwi, the Crown, sector groups and pioneers), supply chain participants (hatchery staff, farmers, processors, wholesalers, retailers), communities, legislators and regulators (central, regional and local government), researchers, and public and private investors.

New Zealand’s seaweed sector is growing rapidly, but without any strategic or structural context. We have an opportunity with the Seaweed Framework to determine and prioritise how the sector can develop in the coming years. Responsibility for implementing the framework lies with current and future seaweed sector participants and stakeholders, and government.

When this framework was tested with sector participants, the resounding feedback was the urgent need to enable new marine based seaweed aquaculture, particularly to open a pathway for commercially-focused research/trials. The call is for a framework that can accept some level of uncertainty of effects and adaptively manage as our experience and understanding develops. The pathway needs to include both marine farm consenting and access to wild seaweed for aquaculture broodstock.

The framework incorporates principles of ecosystem-based management (EBM) alongside Te Ao Māori.

Three priority areas were explored in greater detail: regulation, knowledge and leadership.

Global seaweed sector

There are 3 types of seaweeds or macroalgae: green, red, and brown. All are farmed or harvested in some manner.

Red seaweeds (52%) and brown seaweeds (47%) make up most of the global supply. 85% of farmed seaweed is used for human consumption, either directly or as a food ingredient. The balance (15%) is used for a range of markets including livestock feed supplements, biostimulants, extracts and a range of other uses. Within seaweed food-products, China and Japan are the largest importers representing more than 71% of the global market.

Lower value products dominate volume, but higher value pockets exist and are growing in segments such as food, supplements, and cosmetics where health benefits and environmental credentials are valued in certain markets.

Seaweed makes up almost a third of global aquaculture production volume. Global value of seaweed aquaculture in 2019 was estimated at over US$14 billion with a growth rate of 7% per year on average over the last decade.

Seaweed aquaculture production volume has tripled over the last 20 years and now accounts for 97% of total global production (over 34 million tonnes was aquaculture and just over 1 million tonnes was wild harvest in 2019). Asia dominates seaweed aquaculture (97% in 2019); China (58%), Indonesia (29%), South Korea (5%) and the Philippines (4%) are the top producers.

Domestic rimurimu/seaweed sector

Aotearoa New Zealand has an emerging seaweed sector operating at a small scale with pockets of product innovation. There are almost no data on the scale of the seaweed sector apart from the wild harvest of bladder kelp, Macrocystis pyrifera, which is managed by the quota management system under the Fisheries Act.

Market demand for most seaweed products in New Zealand is immature by comparison with international markets. The majority of New Zealand harvested seaweed is used to produce products for the agricultural and horticultural markets (mainly soil biostimulants and animal feed supplements).

The domestic market for seaweed as food for human consumption is relatively small and undeveloped. Other small volume markets for New Zealand seaweed today include seaweed extracts used in health products, beauty products, and as ingredients to other products. Small scale export of some of these products occurs today.

The seaweed sector is constrained by an underdeveloped local supply chain. Small volumes are harvested from mussel lines (as by-catch or deliberately caught), and from limited wild harvest and beach-cast collection. This supply is supplemented by some imported raw stabilised product that is processed in New Zealand.

Opportunities

Our previous research identified seaweed as a priority opportunity for Aotearoa New Zealand due to the:

- Relatively undeveloped state of the industry

- Significant, growing demand for seaweed-based products

- Large number (900+) of native and endemic species

- Potential for low environmental impact and/or benefits

- Opportunity to develop high-value products over time, that are highly aligned with restorative

economies

Additionally, our large ocean estate and global brand as ‘clean and green’ means we are well placed to leverage the image in overseas markets.

Barriers

Barriers to growth for the domestic seaweed sector include:

- Investment - Risk capital is needed to support early movers that reduce risk for others, sector relevant research and development, and to develop sector infrastructure

- Knowledge - Significant practical knowledge gaps exist on farming New Zealand species, developing value-add products, and understanding environmental impacts

- Regulation - The current regulatory framework is not fit for purpose

- Leadership - There hasn’t (until very recently) been a sector body or common vision to lead the sector

- Markets - Increased supply and scale is required alongside pathways to higher value in order to realise market opportunities

Achieving the 2032 vision

The vision for the domestic seaweed sector is that by 2032 rimurimu/seaweed contributes significantly to Aotearoa New Zealand’s economy and supports thriving ecosystems, communities and culture.

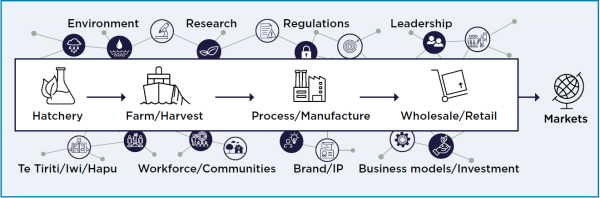

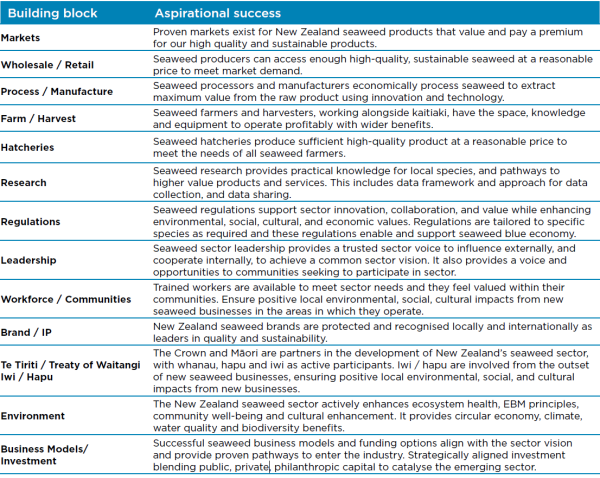

The building blocks for achieving this vision are:

The individual building blocks are interdependent. All building blocks are needed to achieve the vision, collectively.

Our competitive advantage

Aotearoa New Zealand's competitive advantage lies in high-value products for niche markets via technology-led value extraction from native seaweed species via brands with high social and environmental licence.

A pragmatic, phased strategy for domestic seaweed producers is to focus on unmet demand in existing markets, while progressively developing higher value products where technology, scale, investment, and intellectual property permit.

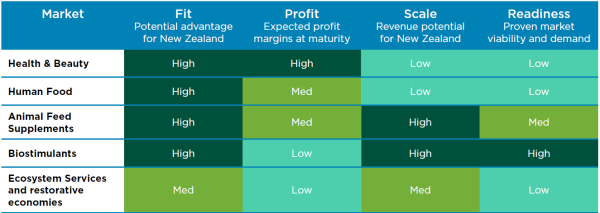

Priority markets for Aotearoa seaweed product and services include:

- Health & beauty

- Human food

- Animal feed supplements

- Biostimulants

- Ecosystem services and restorative economies

Each market has product pathways to higher value, and some have significant unmet demand due to current seaweed supply chain constraints.

Priority local seaweed species for supply vary according to the market being targeted.

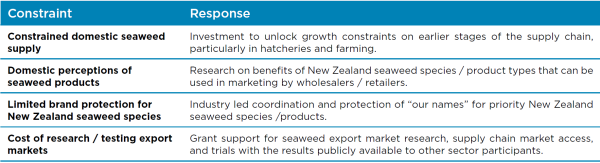

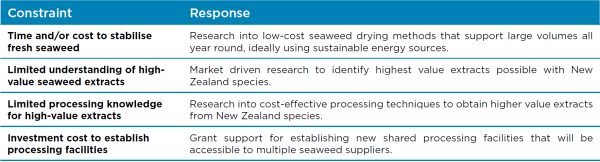

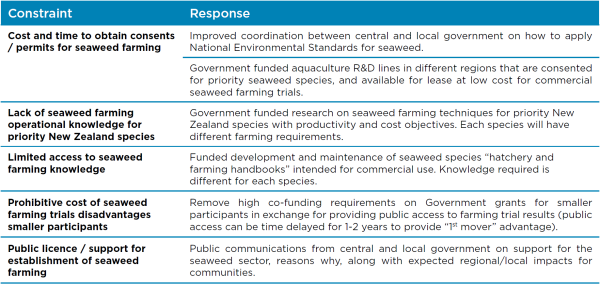

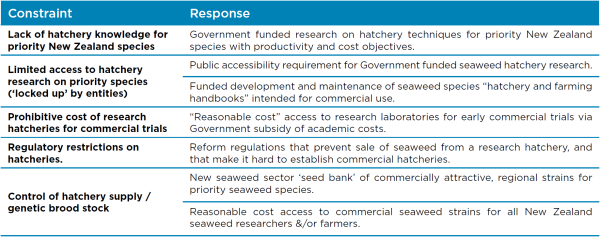

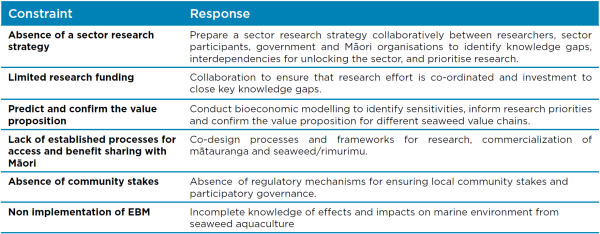

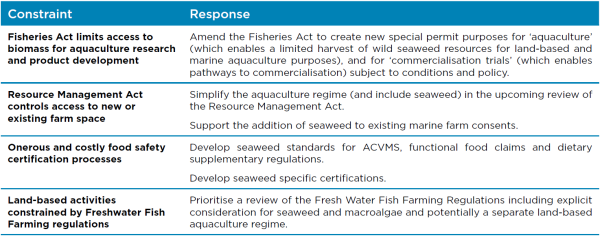

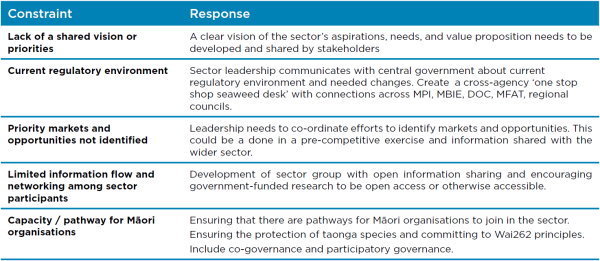

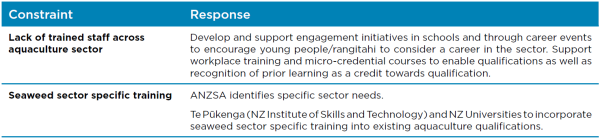

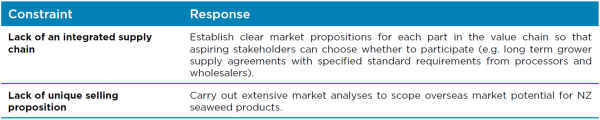

Significant constraints to the seaweed sector’s development and responses have been identified for the supply chain and supporting building blocks.

Priority areas for action

These documents delve deeper into the immediate and medium term priorities for the domestic seaweed sector:

An EBM approach

Ecosystem-based management (EBM) is informed by a range of knowledge sources. Developing a sustainable seaweed industry incorporating EBM principles means including the community, co-governance (if this is a priority for tangata whenua either now or in the future), and appropriate science. Collaborative decision making and adaptability in regional approaches and business models is likely to be required depending on the aspirations of each community.

Considerations for developing a sustainable seaweed sector within an EBM framework include:

- Co-governance - Does genuine partnership exist? How could it be established and underpinned by Te Tiriti principles?

- Collaborative decision making - Who needs to be at the table? How will decisions be made?

- Knowledge-based - What are the knowledge systems being used? What is missing, and how might those gaps be filled? What do we need to know as seaweed aquaculture develops?

- Sustainable - How can the environment and human communities benefit and how can undesirable impacts be avoided or mitigated?

- Adaptable - How can the seaweed sector develop, grow, and respond to new information or changing conditions?

- Tailored - What are the requirements specific to this community, environment type, species, or time?

Priority markets & value pathways

To build a high value sustainable sector, New Zealand producers need to develop high-value products for niche markets with a competitive advantage that can be maintained.

Competitive advantage for Aotearoa seaweed products

Technology-led value extraction from New Zealand seaweed species via brands with high social and environmental licence.

Sector strategy

A pragmatic, phased strategy for New Zealand seaweed product producers is to focus on unmet demand in existing markets (activate), while progressively developing higher value products where technology, scale, funding, and intellectual property permit this (transition).

The transition phase to higher value can be accelerated by investment to develop the seaweed supply chain and support sector growth.

Using a cascading processing approach, it is possible to produce products for multiple markets at once, and to extract maximum value from seaweed. This is evidenced where innovative New Zealand seaweed product producers are leveraging the material, scale, and revenue from lower value products, to concurrently develop higher value products. EBM and community/iwi engagement should be at the core of the sector as it emerges.

Value proposition

These elements can be combined into unique seaweed value proposition(s) for Aotearoa New Zealand:

- Endemic &/or native species

- Scientifically proven product and service benefits

- Authentic brands with high social and environmental licence

- Mātauranga Māori, Māori names, stories, knowledge, and culture

- Intellectual property protection (names, brands, processing, and compounds)

- Restorative ocean farming methods and Southern Pacific Ocean water quality

- Trusted food safety and production standards

- Premium ingredients that build on New Zealand story/brand

5 priority markets

Click the graphic to enlarge

1. Health & beauty

Seaweed extracts for use in beauty, nutraceutical, or pharmaceutical products may emerge as a significant opportunity in time for New Zealand. Premium products such as Crème De La Mer demonstrate the potential from significant investment in research, processing, intellectual property, and marketing. However, this type of success takes time and is not easily replicated.

- Lower value – Non-IP protected active ingredients

- Medium value – IP protected active ingredients; beauty products; nutraceutical products

- Higher value – Pharmaceutical products

Priority New Zealand seaweed species for health and beauty include:

- Karengo (Pyropia & Porphyra) – Antioxidant and anti-inflammatory bioactivities, health promoting amino acids and peptides, and enzymes that can lower blood pressure

- Asparagopsis – Not well studied but used in acne treatment

- Fucoids (Durvillaea & Marginariella) – Fucans with anticoagulant, anti-inflammatory, and anti-viral effects; alginates for hydrogels; and fucoidan with anti-cancer effects

- Kelps (Ecklonia, Lessonia, & Macrocystis) – Fucoidan and carotenoids with antitumour, anti-viral, and anti-inflammatory properties; vitamins and mineral micronutrients

2. Human food

Seaweed consumption in New Zealand is in its infancy compared to markets in Asia, Europe, and North America. Most of the product consumed here is imported from low-cost Asian suppliers as heavily processed pre-packaged snacks and sushi wrap. Traditional high-end export markets such as Japan have high quality requirements and barriers to entry.

- Lower value – Commodity food ingredient (eg agar)

- Medium value – Branded condiments (eg seasonings); Processed food (eg seaweed-infused pasta)

- Higher value – Fresh chilled product (eg restaurant menus); premium processed food with health benefits

Priority New Zealand seaweed species for food include:

- Sea lettuce (Ulva species) – Fresh in salads or soups or dried as a food wrap

- Wakame (Undaria pinnatifida) – Fresh in soups, smoked, or dried as a seasoning

- Karengo (Pyropia & Porphyra) – Boiled fresh or dried as alternative to Japanese nori

- Bladder kelp (Macrocystis pyrifera) – Roasted as chips or dried as a seasoning

3. Animal feed supplements

Seaweed is a small but fast-growing part of the global livestock feed and supplement market. New Zealand seaweed-based feed supplements exist for cattle, horses, pigs, goats, poultry, and bees. There is existing unmet demand due to seaweed supply constraints, and a lot of interest in the potential for seaweed to help reduce methane emissions and urinary nitrogen from livestock.

- Lower value – Processed seaweed feed with anecdotal benefits

- Medium value – Feed supplements with research backed animal health and productivity benefits

- Higher value – Feed supplements with research backed animal health, productivity, and environmental

benefits

Priority New Zealand seaweed species for animal feed include:

- Sea lettuce (Ulva species) – Trace elements, vitamins and immunity benefits via ulvans

- Common kelp (Ecklonia radiata) – Range of animal health and productivity benefits

- Wakame (Undaria pinnatifida) – Immune response, digestion and weight gain benefits

- Bladder kelp (Macrocystis pyrifera) – Rich in iodine and aids mineral absorption

- Asparagopsis – Reduction in livestock methane emissions

4. Biostimulants

Many seaweed biostimulant products exist overseas and in New Zealand. These are applied to soils or sprayed on foliage to promote soil health and plant productivity. Seaweed-based products have significant nutrient/trace element and environmental benefits over synthetic fertilisers. These are sometimes blended with other material to achieve target NPK ratios (nitrogen, phosphorous, potassium). There is unmet domestic and export demand for these products due to seaweed supply constraints. Organic status contributes to higher sales prices

- Lower value – Dried product with anecdotal benefits

- Medium value – Liquid product; research backed formulations

- Higher value – Research backed formulations with organic certification

Priority New Zealand seaweed species for biostimulants include:

- Common kelp (Ecklonia radiata) – Proven soil health and plant productivity benefits

- Wakame (Undaria pinnatifida) – Proven soil health and plant productivity benefits

- Bladder kelp (Macrocystis pyrifera) – Fast growth suits high volume seaweed supply

5. Ecosystem services and restorative economies

The ecosystem benefits of seaweed grown in coastal waters are generally well understood in terms of biodiversity and biomass. The nutrient removal benefits are also well studied, particularly for point source pollution remediation on-land. Other benefits exist in areas such as ocean acidification, deoxygenation, and coastal protection.

More recently, there has been considerable interest in the role of seaweeds in carbon dioxide removal and sequestration. Noting varying examples of payments for these ecosystem services from seaweed are still rare internationally. The use of seaweed in restorative economies can enable thriving marine ecosystems whilst providing social, cultural and economic benefits to iwi and local communities

- Lower value – Non-IP protected active ingredients

- Medium value – IP protected active ingredients; beauty products; nutraceutical products

- Higher value – Pharmaceutical products

Priority New Zealand seaweed species for ecosystem services include:

- Sea lettuce (Ulva species) – Point source pollution nutrient removal on land

- Common kelp (Ecklonia radiata) – Predominant coastal species around Te Ika-a-Māui/the North Island

- Bladder kelp (Macrocystis pyrifera) – Fast growth suits high nutrient/carbon uptake

Supply chain priorities

Each supply chain has different constraints and recommendations to address them.

Wholesale/retail

There are a wide range of wholesale and retail participants in the New Zealand seaweed sector. It is also where the most innovation is present with firms pioneering new products and establishing new domestic/export markets. However, the limited volume and unreliable supply of New Zealand seaweed at a reasonable cost is a major constraint to growth.

Process/manufacture

Transporting and/or stabilising fresh seaweed presents significant cost challenges due to the weight of fresh product, and the time/energy requirements for drying seaweed. Most New Zealand processors use low technology fermentation, but some are investing to extract more value through ‘cascading’ processing steps and new products from ‘waste’.

Farm/harvest

Commercial seaweed aquaculture in New Zealand is in its infancy, and the potential for significant growth from wild harvest and beach cast seaweed is heavily constrained. Current permit holders eligible to farm seaweed are reluctant to invest due to the commercial uncertainty and risk. Consenting new farm space is a slow, costly, and risky process.

Hatcheries

New Zealand does not have any commercial seaweed hatcheries, and this is a fundamental infrastructure constraint to establishing large scale seaweed farming in New Zealand. Investment will not occur at scale in commercial seaweed farms without a reliable supply of juvenile seaweed. Current aquaculture production of seaweed occurs at small scale in research hatcheries.

Knowledge

Practical and underpinning knowledge for producing New Zealand seaweeds and products is limited as well as established processes for access and benefit sharing with Māori. Without investment to build our knowledge base, the seaweed sector will fail to realise its full potential and meet the expectations of Māori. International knowledge and experience should be adapted as appropriate to help establish the New Zealand sector.

Regulation

The seaweed sector is currently regulated under a complex mix of policy and regulations that were developed to manage a wide variety of activities. The regulatory framework is not-fit-for purpose and needs updating to unlock sector potential and ensure sector development within an EBM framework, including co-governance and community participation.

Leadership

The seaweed sector is currently made up of a wide range of businesses, organisations and aspiring participants. All these groups have different needs and are sending different messages about the potential value and current barriers to the sector achieving this value. Sector participants have joined together to address these issues and have recently launched the Aotearoa New Zealand Seaweed Association (ANZSA), to champion the needs of the sector.

Workforce

The existing aquaculture and supporting work force is experiencing staff shortages at all levels but particularly on farm workers in regional parts of New Zealand. Much of the skills required for seaweed farming are readily transferable from the wider aquaculture industry and other sectors (eg marketing and sales) but specific training is also needed, for example for hatchery production and processing.

Brand/IP

New Zealand has some award-winning seaweed businesses that have compelling product stories. However, it is unclear whether there is a viable supply chain for these products that adequately rewards farmers and growers to invest in seaweed farming.

New Zealand does not have a clear unique competitive advantage that differentiates our product(s) from those of overseas competitors and it is unknown whether our native species have unique properties that are marketable and can be sold at a premium.

Te Tiriti

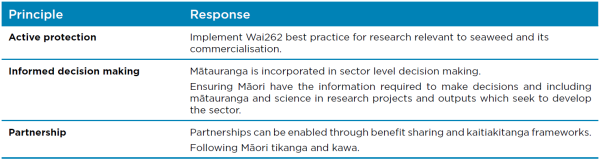

Tiriti principles of participation, protection and partnership act as guideline for the sector to ensure Māori, iwi, and hapu can effectively participate and engage with the developing seaweed sector. Principles of note include active protection, informed decision making and partnership.

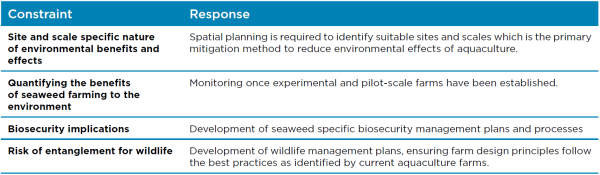

Environment

Current understanding/research on the environmental benefits or ecosystem services of natural seaweed beds are well known. Research is underway to understand environmental impacts of seaweed aquaculture farms. While the potential for seaweed aquaculture to supply ecosystem services beyond the provision of biomass is promoted as a benefit of seaweed farming, the delivery and quantum of this is highly dependent on scale and context.

Seaweed farming is considered to have a lower environmental risk than most other forms of aquaculture. Genetic interactions with wild populations, disease and marine pests, and wildlife entanglement pose the greatest environmental risk.

Infographic - Environmental effects

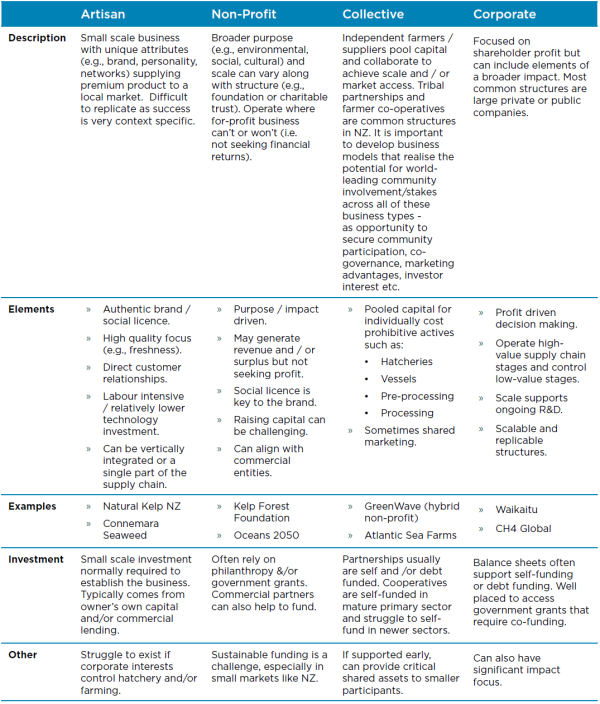

Business models & investment

Different business models can contribute to the development of a high-value and sustainable seaweed sector. Different models will coexist, and hybrids or variations of each are possible (eg a not-for-profit Foundation operating alongside a for-profit entity or tikanga-led corporate businesses).

Click the graphic to enlarge

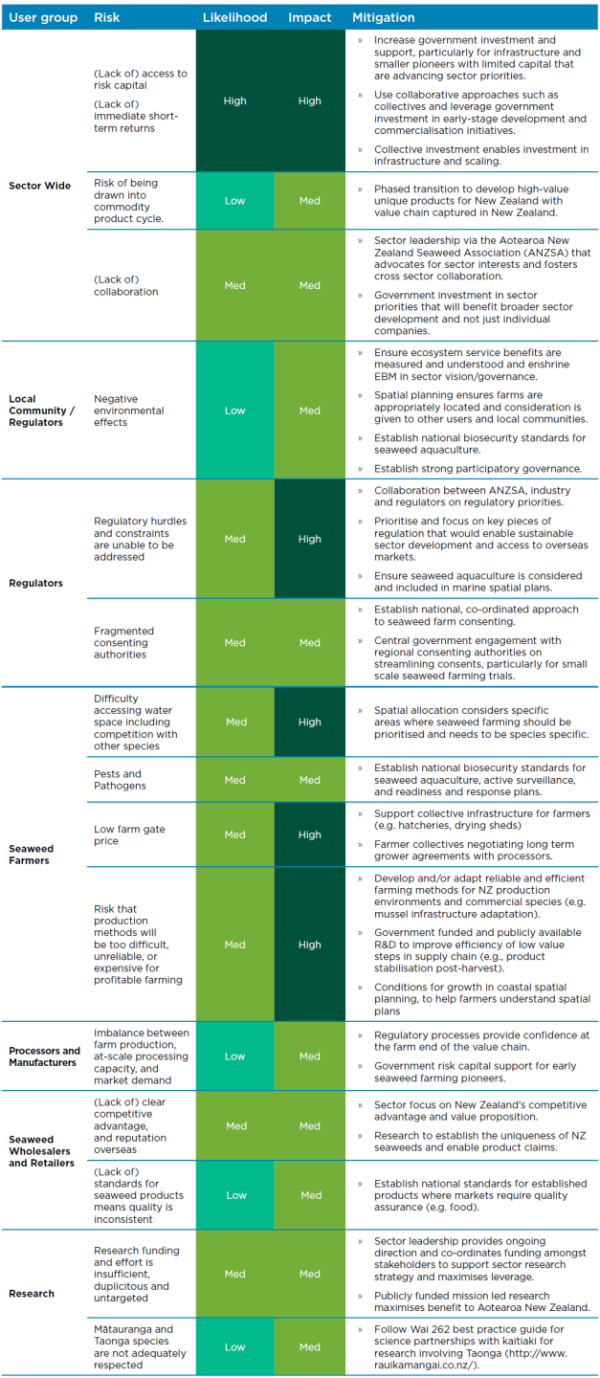

Sector development risks

There are significant risks to achieving the sector’s vision that need to be managed through a co-ordinated approach by the industry, government, stakeholders and researchers.

Click the graphic to enlarge

Industry case studies

The framework has been refined via industry case studies including:

Seaweed sector review

The framework is underpinned by a comprehensive sector review: